Buildings of reinforced concrete offer several advantages including long life and less maintenance, this is especially true for low-rise buildings. For those who are considering property investment in Japan, this article might help to hint you with some ideas.

In Japan, the statutory durable year of property is specified by Tokyo Bureau of Taxation based on the construction materials used. For example, the statutory durable years of wooden house is 22 years while it is 47 years for house constructed of reinforced concrete. As this statutory durable year will further affect the property value, buildings with reinforced concrete (RC buildings) are always be recommended for long-term investments. In fact, RC buildings is not only have longer durable years, but also have other merits that are good for investment.

■ Merits of investing RC En-bloc Residential Building

- ① Merits of buildings constructed with reinforced concrete materials

Higher protection for earthquake, fire and noise.

As compared with wood or steel frame, RC has higher protection for earthquake, fire and noise. With higher noise protection function, the trouble between neighborhood could be reduced, which help to extend tenancy period and enhance the stability of rental return. Also, the fire insurance fee will be cheaper for buildings built with RC than wood. Stronger earthquake protection can reduce the damages of the building and amenities during earthquake. Furthermore, the damage caused by typhoon also be lowered. As a result, the asset value of the building could be lengthened in long term.

- ② Merits of newly built building

Stable rental return for longer period

Generally, the rental rate decreased with increasing building age, and vacancy rate increased if there is a lot of competitive property around. Since the construction rules for building with RC materials are strict, there are fewer RC built building in the market as compared with that built with wood or steel frame materials. If the RC building was newly built, higher rental rate with higher occupancy rate is expected. Moreover, the decreasing rate of rental following with building age is also slower. In fact, during these 2 years of covid-19, the occupancy rate is seldom be affected for RC buildings like the residential brands of COCOCUBE and COCOFLAT. In addition, moving house in Japan involving large amount of fee such as cost of moving, deposit, agency fee, etc which make people tend to stay in the same place even if there is another choice with lower rental.

Better conditions for loan application

Most of the investors tend to apply loan for property investment. However, it is normally hard to get full loan approval with the strict evaluation of financial institutes, especially for property with value over 100 million. Nevertheless, RC buildings with lesser building age and good condition have greater chance to get mortgage with a maximum of 35 years.

- ③ Merits of compact and low-rise building

No elevator needed for low-rise building

As per the construction laws in Japan, building with height higher than 31m should be equipped with elevator. Although the number of floors has not been specified, most of the cases showed that elevator is required for building with 6 floors or above. As the use of building area can be maximized without elevator, profits can be maximized for the reasons of lower cost of regular maintenance, zero cost for elevator replacement in every 20 years. Some might worry that it is hard to rent out flats on upper floors if no elevator facilitated. Although it is the fact that lower floors of a no elevator building might be more popular and easier to rent out, flats on the upper floors are still welcomed by tenants if the building was in convenient location and built with good plan and leased with reasonable rate.

Comparatively reasonable price even built with RC materials

Normally, the construction fee for RC buildings is relatively expensive. For those large-scale buildings with elevator, the price will be quite expensive which might be difficult for individual investors to acquire. Instead, for those small-scale low-rise buildings (below 5-storey) without elevator with land area around 66sqm to 99sqm in Tokyo 23 wards, most of the price is around 200 million yen that might be more reachable for individual investors or business owners of Small and Medium-sized Enterprise (SME).

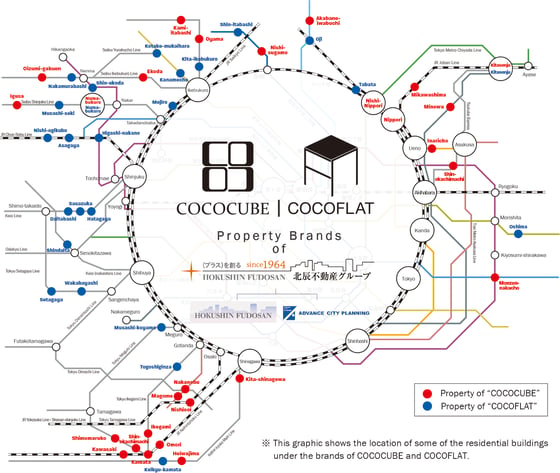

In the real estate market of Japan, there might be a lot of RC buildings with different scales and under different property brands. As discussed above, newly built and low-rise RC buildings are more favourable for long-term investment with reasonable price. However, the stock of this kind of RC buildings are extremely limited in the market as this is always favoured by investors. For example, over 60 residential buildings under the brands of COCOCUBE and COCOFLAT developed in the past years had been acquired by investors and are under the management of the Hokushin Fudosan Group, the developer of these two brands which is a property company in Tokyo with over 55 experiences in the real estate market. Under the group's management, the average occupancy rate is above 95%. Below are reasons behind for their success.

■ Why investors chose RC En-bloc Residential Building of COCOCUBE and COCOFLAT?

- ① One-stop service provide by Hokushin Fudosan Group

Be a long-term partner starting from building acquisition

The residential buildings of COCOCUBE and COCOFLAT under Hokushin Fudosan Group are developed from land acquisition, architectural design, building construction, leasing, management and sell as an investment property. With well understanding of the building structure, more appropriable building management service can be provided which help to sustain its value in long term. In this regard, high quality one-stop service can be provided after property acquirement and Hokushin Fudosan Group can be a long- term partner with the investors.

*To learn more about Hokushin Fudosan Group, please click here.

- ② All residential buildings are in good location

Good location means high occupancy rate

All residential buildings of COCOCUBE and COCOFLAT are located at good place in Tokyo 23 wards with less than 10-minute walk from station. With good accessibility and its convenience commuting between home and work, high occupancy rate can be maintained. In fact, all buildings managed by the group has kept at an occupancy rate of 95.83%. Hence, the returns tend to be more stable and the property value is more sustainable.

- ③ Strive the balance between profitability and functionality

Unique know-how developed from the experience of over 60 buildings

It is important for an investment property to keep its competitive power among others. Striving for the balance between cost and profit by lowering the construction fee to maximize the return of profit is vital but at the same time the needs of potential tenants also cannot be neglected. Unique functional design of the building with pertinent cost is the edge of the group to differentiate its brands from other competitors. With the accumulated experience in developing for over 60 residential buildings of COCOCUBE and COCOFLAT, the group has developed its own expertise in designing the outlook and interior of the buildings as well as in selecting specified amenities to fulfill the needs matching the characters of the adjacent area. Hence, the competitive power of these buildings can be sustained with its unique functional design that can satisfy the demand in the leasing market. These brand edges are highly appraised by existing investors.

* Please click here to check for the property currently on sale.

(REF: B-PI-01)